At option expiration, the sweet spot is about S+P 1990 from our hedges. It is a wide target from 1980 to 2000 due to uncertainty. That is the projection from the option market, and simply their best guess as it stands now. Today, the sweet spot would be about 2004, but we sit at 1979 or so SPX. Again, that is just their best guess at evaluating options, the result of us putting on options at the best market spots at the moment with reasonable spreads.

That is a snap at the Closing Bell. It may settle more, but seems stable for now. I added more Gold Miners Hedges earlier as they were down a bit today, plus sold some VIX calls. It will settle for 15 minutes usually after the Closing Bell.

So that is how it eventually ended up.

Thursday Update:

Silver and Junior Gold Miners down a bit to start with S+P. Added to Silver and Jr. Miners before 10. Miners have a volatility premium, or high time value for money, that we try to capitalise on.

We have closed down slightly after all that rebalancing. You win some, you lose some. It's not all wine and roses after all.

Wednesday Update:

A look at the Volatility Surface might be in order.

This is a typical implied volatility surface from the Volatility Smile Wiki. What we are trying to do is take advantage of the steep drop in value as DTM Days to Maturity approaches 0 or expiry. We concentrate on the last month, but it shows the last 3 months or 90 days generally start the decline in at the money options from the maximum premium. The back wall is Volatility. Relative changes in Delta, or Gamma, are less effective in the last month. Here's Today's Close.

Tuesday Update:

I guess Top Posting is the default for a blog, whereby the latest addition is added to the top. I guess the main thing is that I am free to write about how this goes instead of sitting transfixed with the laptop on the Loo waiting like a cat to pounce on a mouse. There is a lot to be said for boring in this financial world. Make a little money all the time is better than wins and losses any day of the week, and even if your ratio is better than the standard 1 out of 3.

However, can't get too complacent like a bird. We still have to pay attention to the flying, sensing that any down draft is an opportunity in waiting because that means there is also an up draft somewhere nearby, and we might want to load up to take advantage of the coming up current. We may flap our wings once to move laterally, but the rest is gliding. Today it looks like the S+P will open up in a few minutes.

The world is falling apart and stocks are still rising. Do people finally understand that Inflation makes the bottom line grow fonder? I doubt it. It can be our little secret like a clandestine Pachyderm in a Pinto.

Here we are after 15 minutes, showing a little skin as it were. Down a bit. We use the aileron feathers to bank into the wind with a slight readjustment. Coming up to the 11 o'clock time frame, we have recovered slightly after dipping as low as 2 meg down. That is to be expected when these positions are so young. As they age, they will fly better we hope. We had to kick them out of the nest early, but we are like their doting mother birds swooping in underneath to catch them if they fall. Their siblings have already caught the drift.

Maybe we are just a little batty, and these kids are like flying vermin, but they are Our vermin. Now the ES is making new highs and SPX hitting 1986.24, but there may be a correction in store... Nope. Until 2 PM, it was unsettled sideways.

Now some of you may be thinking there is a Condor Option Spread analogy, but no. Condors use two longs and two shorts at 4 different adjacent strikes. Butterfly may be better but same deal; two longs two shorts. There is also a "Batman" spread but this is not that. Option Spreads also aim to hedge, or limit, risk while profiting from time. They may be better for you, but this is fine for me. Everybody always tells me how great their system is. They haven't got back to me since my Bottom Line was deemed too injurious to their insensibilities.

I wonder how they have fared over that chart? There appears to be a sharp sell-off on ES after the bell. And that is just another predictably unpredictable day. We have 24 more including another settlement day. Just like Hamsters, there will be another batch next month, and they grow exponentially towards birth, in the last 28 days. Gestation period: 18-21 days Litter size: 1-14 (average 4) Weaning age: 3-4 weeks. Flying Squirrels are 40 days. Bats are longer; 50-240 days. We will skip the eating our young part at that point though as we have the wherewithal to knit booties and school uniforms for all of them. As you remember, the last week before expiration is the biggest growth in our Happy little Squirrelly-Hamster-Bat home here. Another analogy would be Wine Making, but while being rewarding, it's not as much fun as this.

The other thing I always wonder about is what happens during that 15 minutes after the bell until they get the final answer for the day? I have written it off to balancing the books, but it is something more than just that when they can't decide on an answer between 1.5 and 2.5. Maybe you know.

<3

Monday Update:

All of our In The Money expired positions have now been exercised, before the Market Open, and we have choices. We can clear them or hold them. In the case of HTB Short Positions, we would have to pay interest on them for as long as we held them.

The top is Friday Close while the bottom is Monday Pre-Open after the ITM options have been exercised. We intentionally left the ITM positions to see what would happen. We also appear to have made about $14 M and change before anything starts.

A few minutes after the open it is still moving, but we captured it. We have to decide before market close today, 72 hours after expiry, what we want to do about all those shares.

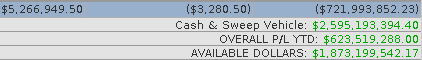

Well it took us a little while, but we have squared up. Note the P/L YTD is up from hedges we had the foresight to add Friday Afternoon. It is 10:18 Eastern. We are down 48M on the P/L Open because some hedges have ITM options open as far out as December and September Expiration, but the winning sides outweigh them substantially. After cleaning out the old ITM hedge positions, we are here at about 11:15 NY...

The rest of the day was boring. At the close, the top line shows what we got from cleaning up the assignments.

<3

No comments:

Post a Comment