Tuesday, March 22: It's already past quad witch. I'm at about 3.5 billlion YTD.

Friday, March 11, 2016: It is a week before Quadruple Witching. We were hedged flat as we could, but as the volatility lessens, the balance has been changing.

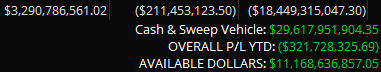

The overall picture is here:

Next week will be VIX expiration, then all hell will break loose as usual. There is an FOMC Meeting, so lots of Fed jiggery pokery on Wednesday after VIX expires for March. We will see. It is a full calendar.

Thurs, March 3, 2016: Even keeping a flat hedge is difficult in this volatile environment. VIX remains artificially low, 16.7 to 17, and option premiums do not reflect true value. A rally over the past three days has petered out on speculation of a Fed rate hike skip this month, but recently good economic news The S+P 500 futures are around a 1980 average now.

The main takeaway is that if I can think of this, it is probably being done somewhere. Looking at the resumed performance of financials, it looks like great minds think alike, or fools seldom differ. You'll have to make that call. I still have a $2B spot this year to pay back. The new year crush was hard.

Thurs, Feb 25, 2016: I have it back up. February was an awful month. ToS now requires Java 8 from Oracle. I had the old Java, and thought it wouldn't update any more. Here is how it stands after a rare three days up on the S+P.

Looking at he S+P options, the shorts outweigh the longs by 5 to one, so it is a historically crowded trade to the downside with futures now at 1950 recovering from 1812 or so weeks ago. Sentiment is mixed, but still forecasting flat or worse for the future. They said this is the largest short interest in history on the S+P 500, so they aren't really believing the mini rally will continue off that dip. Only time will tell.

Saturday Jan 30, 2016: Have to shut it down for medical reasons here. Unable to keep on top of it all. It may still be going, and may be even up a little with the S+P and fuel rising. I just have to close it all out now.

If you have your health, you could try the same thing. I found ToS from an ad years ago, and looked into it back in the old days before it was TD. That was before my options lost buying power prints, citing "split position." TD said they would get option trading in Canada, but they never did. You had to go to the TD Ameritrade side to do that. I tried IB, but developed a palsy making it difficult to control the mouse. It did not have enough to mimic my trades also. So that is what happened to me there.

Sunday Jan 24, 2016: It got worse, but that was close to scraping the bottom of the barrel. The whole thing is oil. It has such a pro-con to the economy weight wise, and has so much hedged weight, the little fish, equities, have to go with the flow. We are a worldwide oil based civilization, and that was proof. I intentionally tried to ignore oil to hedge against it, but obviously not enough. Money has hung its hat on oil since Rockefeller Jr. was poopin' yellow. This is after a readjustment, but I would need a lot more downside prevention to stop that slide. Lessons learned.

I have a 2 Billion float that I borrowed from the Fed. 0.25 % apparently. I used to work in oil before I got hurt. It seemed like a good short hedge then for me. You can bet there will be a lot of longs on it if you dare call bottom. Oil is getting near oversold territory now. Still, hedgers are bound to carry this price forward for consumption. S+P may be financial king, but oil is the main world growth driver. Sequestered solar energy. It's how it all works. Everybody else hedges too and there is no relief. Too crowded... for now. Income fund makers I feel your pain.

Be careful what you wish for, methinks. lol

Weds Jan 20, 2016: It is officially a bear market now. The short side has been too crowded.

Fri Jan 8, 2016. Unprecedented first opening down week in history. S+P Futures touched 1910. Holding the broken hedges in the overwhelming down trend. Gold reflects a geopolitical shock component, but energy is still down. Jobs were up, signalling a suspected continuation of interest rate tightening, and touching off yet another late day sell off. We are down a few months to start with a ten percent correction possible. I saw WTI 32.89. Commodities are a major component of the Canadian Economy, and it is reflected in our low valued currency. There is no carrot there hedging forward commodity production. Generally, it is an across the board value reduction now. Who would think we would look to December as the good old days?

That is where we are headed as the hedges can't keep up. China is unpredictable to add to the malaise like 1980 all over again.

Weds, Jan 6, 2016: The year is off to a bad start, and the hedges are broken with the downside crowded. Monday opened with a large loss, followed by today with a dip to 1970.5 on S+P March Futures. What can you do, but try to get that second dip after 1990 Monday? North Korea claims to have a hydrogen bomb, so that cratered it today, along with oil WTI hitting $33.77. China is experimenting, and failing, cushioning the market. It's all bad today, so maybe an inflection is all I can guess.

The word from the Fed is stay the course with interest rates for now. This will look to be an interesting year if we can go by what we've seen so far. There is opportunity in those crowded hedges, but on the other side possibly.

Thurs, Dec 31, 2015: It faded he last two days of the year as predicted, but the downside appears to have been crowded. With a drop from 2055-2015 to end the year, ES March Futures, here is where it sits at about 6 EST.

So we held the $10B YTD line anyway, even with the crowding, with the S+P giving up 20 handles. The Upside actually still made money after settling. Every kid and his dog was calling for a correction. Now we start a New Year.

Tues, Dec 22, 2015: It is a tough spot, rolling this behemoth into next year. We've had a couple days where S+P ripped to 2035 March ES Futures, after a two day dip to close the December Quad Witch fourth quarterin a trainwreck. I loaded up on the long side during the Thurs/Fri Expiry crash, and attempted to hedge that in at the close today. We are still long.

The overall picture is sitting here.

There is a big up rip after the Bell, now about +472M, so the weight is still long. I tried to balance it, but there will be a lot more to go to flatten an apparent Santa Claus rally. P/L YTD will drop to Zero on New Year's of course. It's that quirky calendar year versus fiscal year thing.

What will 2016 shape up like as the Treasury Bonds start their march back to normal? Nobody is sure, including the Fed. Easy money is gone for the short term, but at least time value may be restored somewhat. I achieved trying to keep commissions at 0.1% of Buying Power if anything, but missed the mark trying for a billion a month. The weight would be unrealistic, as it approaches Market Maker status of entire exchanges. It provides a unique insight into the internals and particularly how the whole market is hedged in an ongoing and sustainable basis, albeit not at as many price points. I notice when this account feels pain, it gets into the conversation on CNBC. They feel it too on the NYSE floor.